Sportsbooks offer many different kinds of betting options. Many of these bets have moneylines that means the odds can change. The vig amount for different types bets can vary. If you bet on an underdog with positive odds, it might appear that there is no additional vig, but in reality, the vig has been added somewhere else.

Vigorish

Vigorish describes the amount a bookmaker charges to place a bet. It is also used to refer to interest owed by a loanshark. The Yiddish language, a loanword originating in Russian and Ukrainian, was the first to translate the word into English. It is now an informal expression that is widely used.

The word was originally not pronounced or spelled the same way today. The term was first used for a fee to a publisher before being added to Webster’s dictionary. It is believed that it originated in Yiddish. The word vignes, which was the Yiddish word for "vigors", was what the word came originally. It is believed to have been borrowed form the word vyigrysh which means "gains".

Overround

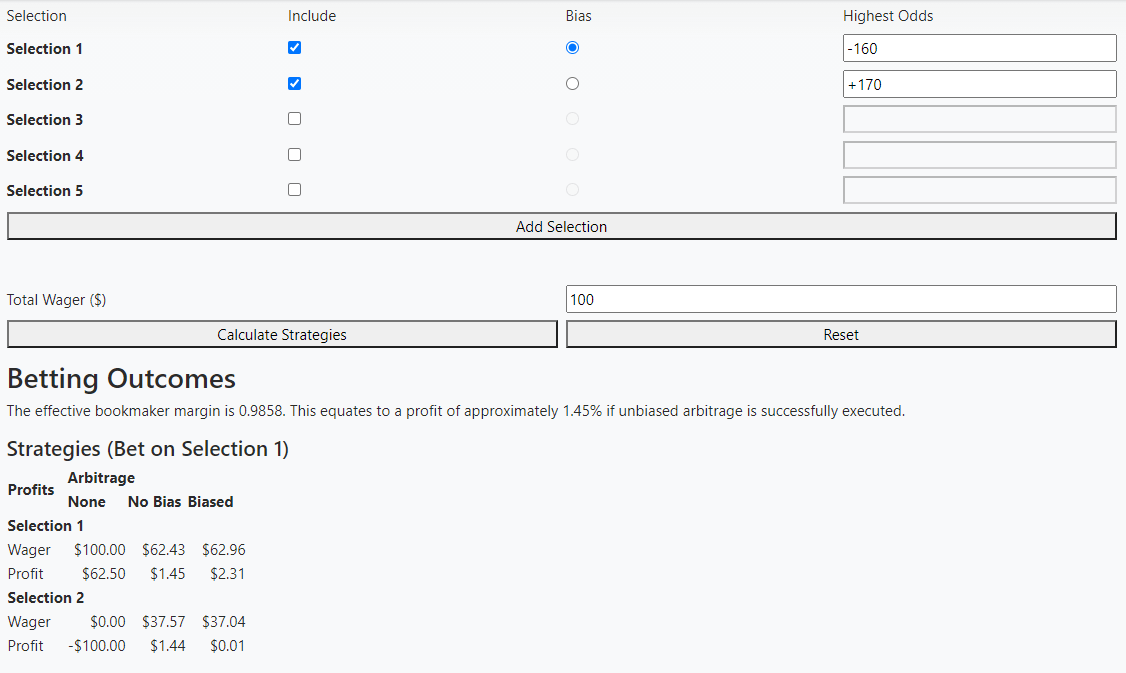

Overround Vig is an additional fee that sportsbooks add to betting lines. It's a percentage of the implied probability total for both teams. If the Bucs are at +300 to win, the overround is 105 per cent. This means that the sportsbook is making 4.76% of the implied probability total, which is just under the threshold for the associated betting line profit.

The overround vib differs from one book and the other. Some bookmakers will increase the margin more than others. In other instances, a bookie might have a smaller margin. It's also known as the juice and vigorish.

Calculation of Vigor

The vigorish calculations is a mathematical method to calculate the percentage of a winning bet. It is commonly calculated as proportional to the true odds. A "fair" line of betting would have odds of 2:1. This helps keep bets more evenly balanced. One example is that two people may agree to place a wager on the sport event "evens." The stakes are split if one loses.

If both sides have an equal chance of winning, the Vigorish Calculation is used to maximize their winnings. For example, if the odds of winning are -110 for a bettor and the vigorish calculation is -100 for a bookmaker, he would need to pay 110 in order to win $100. The loser will lose under the "juiced" odds and loses ten per cent of his wager. The winner, on the other hand, receives the 110 plus one hundred. This way, the winner is still ahead of the loser, because he is up a hundred dollars regardless.

vigorish percentage

What is the percentage of vigorish in sports betting. Vigorish can be defined as the percentage of a site's odds that is paid to a gambler, whether they are the winner or losers. Sometimes both. But vigorish is difficult to measure without knowing how a bettor is likely to behave. It is difficult to calculate a percentage of vigorish based on many factors such as the quality or odds and the team's record at home and away.

Kelly gamblers aim to grow their bankroll at the fastest pace possible. He will place more bets when the payout reflects an advantage. If the vigorish rate is 20 percent, Kelly will wager only half the amount at fair odds.

Calculating vig

Many sportsbooks also add a surcharge to bettors' winnings. It is a fee that a sportsbook charges for each bet. Because it is more difficult to conceal, the vig in futures markets can be higher than regular markets. This will help you to place bets more effectively by understanding how to calculate it.

Sportsbooks are also able to adjust the vig for certain bets. The vig for one side may be higher than the other depending on the win probability or the amount wagered. If you wagered $100 on Team A-7, you would win $87. On Team B +7, you would win $100.

FAQ

How to create a passive income stream

To earn consistent earnings from the same source, it is important to understand why people make purchases.

That means understanding their needs and wants. You must learn how to connect with people and sell to them.

The next step is how to convert leads and sales. To keep clients happy, you must be proficient in customer service.

Every product or service has a buyer, even though you may not be aware of it. If you know the buyer, you can build your entire business around him/her.

You have to put in a lot of effort to become millionaire. It takes even more work to become a billionaire. Why? To become a millionaire you must first be a thousandaire.

Finally, you can become a millionaire. Finally, you must become a billionaire. It is the same for becoming a billionaire.

How does one become billionaire? It starts with being a millionaire. All you have do is earn money to get there.

But before you can begin earning money, you have to get started. Let's now talk about how you can get started.

What side hustles are the most profitable?

Side hustle is a term used to describe any side income streams that can supplement your main source.

Side hustles provide extra income for fun activities and bills.

In addition, side hustles also help you save more money for retirement, give you time flexibility, and may even increase your earning potential.

There are two types. Online businesses, such as blogs, ecommerce stores and freelancing, are passive side hustles. Some of the active side hustles are tutoring, dog walking and selling eBay items.

Side hustles are smart and can fit into your life. You might consider starting your own fitness business if you enjoy working out. Consider becoming a freelance landscaper, if you like spending time outdoors.

Side hustles can be found anywhere. You can find side hustles anywhere.

One example is to open your own graphic design studio, if graphic design experience is something you have. Perhaps you are a skilled writer, why not open your own graphic design studio?

You should do extensive research and planning before you begin any side hustle. This way, when the opportunity arises, you'll be ready to jump right in and take advantage of it.

Side hustles are not just about making money. Side hustles are about creating wealth and freedom.

There are many ways to make money today so there's no reason not to start one.

What is personal finance?

Personal finance is the art of managing your own finances to help you achieve your financial goals. It is about understanding your finances, knowing your budget, and balancing your desires against your needs.

By mastering these skills, you'll become financially independent, which means you don't depend on anyone else to provide for you. You won't have to worry about paying rent, utilities or other bills each month.

And learning how to manage your money doesn't just help you get ahead. It can make you happier. When you feel good about your finances, you tend to be less stressed, get promoted faster, and enjoy life more.

So, who cares about personal financial matters? Everyone does! Personal finance is one the most sought-after topics on the Internet. Google Trends has shown that searches for personal finance have increased 1,600% from 2004 to 2014.

Today's smartphone users use their phones to compare prices, track budgets and build wealth. You can read blogs such as this one, view videos on YouTube about personal finances, and listen to podcasts that discuss investing.

Bankrate.com estimates that Americans spend on average 4 hours per day viewing TV, listening to music and playing video games, as well reading books and talking with friends. Only two hours are left each day to do the rest of what is important.

You'll be able take advantage of your time when you understand personal finance.

How much debt is too much?

It is essential to remember that money is not unlimited. Spending more than what you earn can lead to cash running out. This is because savings takes time to grow. When you run out of money, reduce your spending.

But how much is too much? There isn't an exact number that applies to everyone, but the general rule is that you should aim to live within 10% of your income. That way, you won't go broke even after years of saving.

This means that if you make $10,000 yearly, you shouldn't spend more than $1,000 monthly. You should not spend more than $2,000 a month if you have $20,000 in annual income. If you earn $50,000, you should not spend more than $5,000 per calendar month.

It's important to pay off any debts as soon and as quickly as you can. This includes student loans, credit card debts, car payments, and credit card bill. Once those are paid off, you'll have extra money left over to save.

It is best to consider whether or not you wish to invest any excess income. If you decide to put your money toward stocks or bonds, you could lose money if the stock market falls. But if you choose to put it into a savings account, you can expect interest to compound over time.

Let's suppose, for instance, that you put aside $100 every week to save. Over five years, that would add up to $500. Over six years, that would amount to $1,000. In eight years you would have almost $3,000 saved in the bank. When you turn ten, you will have almost $13,000 in savings.

After fifteen years, your savings account will have $40,000 left. That's pretty impressive. However, this amount would have earned you interest if it had been invested in stock market during the exact same period. Instead of $40,000, you'd now have more than $57,000.

You need to be able to manage your finances well. Otherwise, you might wind up with far more money than you planned.

What is the difference between passive income and active income?

Passive income means that you can make money with little effort. Active income requires hard work and effort.

If you are able to create value for somebody else, then that's called active income. If you provide a service or product that someone is interested in, you can earn money. Examples include creating a website, selling products online and writing an ebook.

Passive income is great because it allows you to focus on more important things while still making money. Many people aren’t interested in working for their own money. So they choose to invest time and energy into earning passive income.

Passive income doesn't last forever, which is the problem. If you wait too long before you start to earn passive income, it's possible that you will run out.

It is possible to burn out if your passive income efforts are too intense. It's better to get started now than later. If you wait too long to begin building passive income you will likely miss out on potential opportunities to maximize earnings.

There are three types or passive income streams.

-

There are many options for businesses: You can own a franchise, start a blog, become a freelancer or rent out real estate.

-

Investments - these include stocks and bonds, mutual funds, and ETFs

-

Real estate - This includes buying and flipping homes, renting properties, and investing in commercial real property.

How does a rich person make passive income?

There are two main ways to make money online. The first is to create great products or services that people love and will pay for. This is what we call "earning money".

The second is to find a method to give value to others while not spending too much time creating products. This is called passive income.

Let's suppose you have an app company. Your job involves developing apps. But instead of selling them directly to users, you decide to give them away for free. Because you don't rely on paying customers, this is a great business model. Instead, advertising revenue is your only source of income.

In order to support yourself as you build your company, it may be possible to charge monthly fees.

This is how internet entrepreneurs who are successful today make their money. Instead of making things, they focus on creating value for others.

Statistics

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

External Links

How To

How to Make Money Online Without Any Experience

There are many different ways to make money online. Some people prefer to use their computers for work, while others prefer to go outside and interact with other human beings.

No matter your status, there's always room for improvement. Here we will look at some simple ways to improve your life.

Since its beginnings, blogging is growing exponentially. Anyone with a computer can now start a blog to make money.

A blog isn't only free but also very simple to set up. You don't need to know much about blogging. All you need is a domain name, and a hosting service.

Selling photos online is one of the easiest ways to make money online today. It doesn't really matter if you are a good photographer or not.

It takes only a good quality digital camera, and a decent image editor application like Adobe Photoshop Elements. Once you have those items, you are able to upload your images to Fotolia, where millions of people visit every day to download high-quality photographs.

Sell your skills if they are relevant to you. You can sell your skills online, regardless of whether you are a skilled writer or fluent in multiple languages.

Elance, a website that connects freelancers to businesses looking for their services, is one example. Freelancers are asked to bid on projects that they have. The project is completed when the highest bidder wins it.

-

You can create an ebook and then sell it on Amazon

Amazon is the leading e-commerce site today. They offer a marketplace that allows people to sell and buy items.

This can be done by creating an ebook that you sell through Amazon. This option is great because you are paid per sale and not per page.

Teaching abroad is another way to earn extra cash without leaving your home country. Teachers Pay Teachers helps students and teachers connect.

You can teach any subject, including math, science, history, geography, art, music, or 5. even Use foreign Google languages.

-

Google Write Adsense articles is another free website advertising system that google offers. You place small ads on your website when someone visits it. These ads appear on any webpage that is viewed by visitors.

The more traffic you have, the more you will make.

Digital selling is also possible. Sites like Etsy are used by many artists to list and sell artwork.

Etsy allows users the ability to create virtual stores that behave like real shops.

-

Get a job as a freelancer

College graduates are increasingly interested in freelancing. As the economy continues its upward trend, more companies outsource their jobs to independent contractors.

It's a win-win situation for both employers and employees. Employers save money because they no longer need to pay benefits and payroll taxes. Employees enjoy flexibility and earn additional income by being able to adjust their work hours.