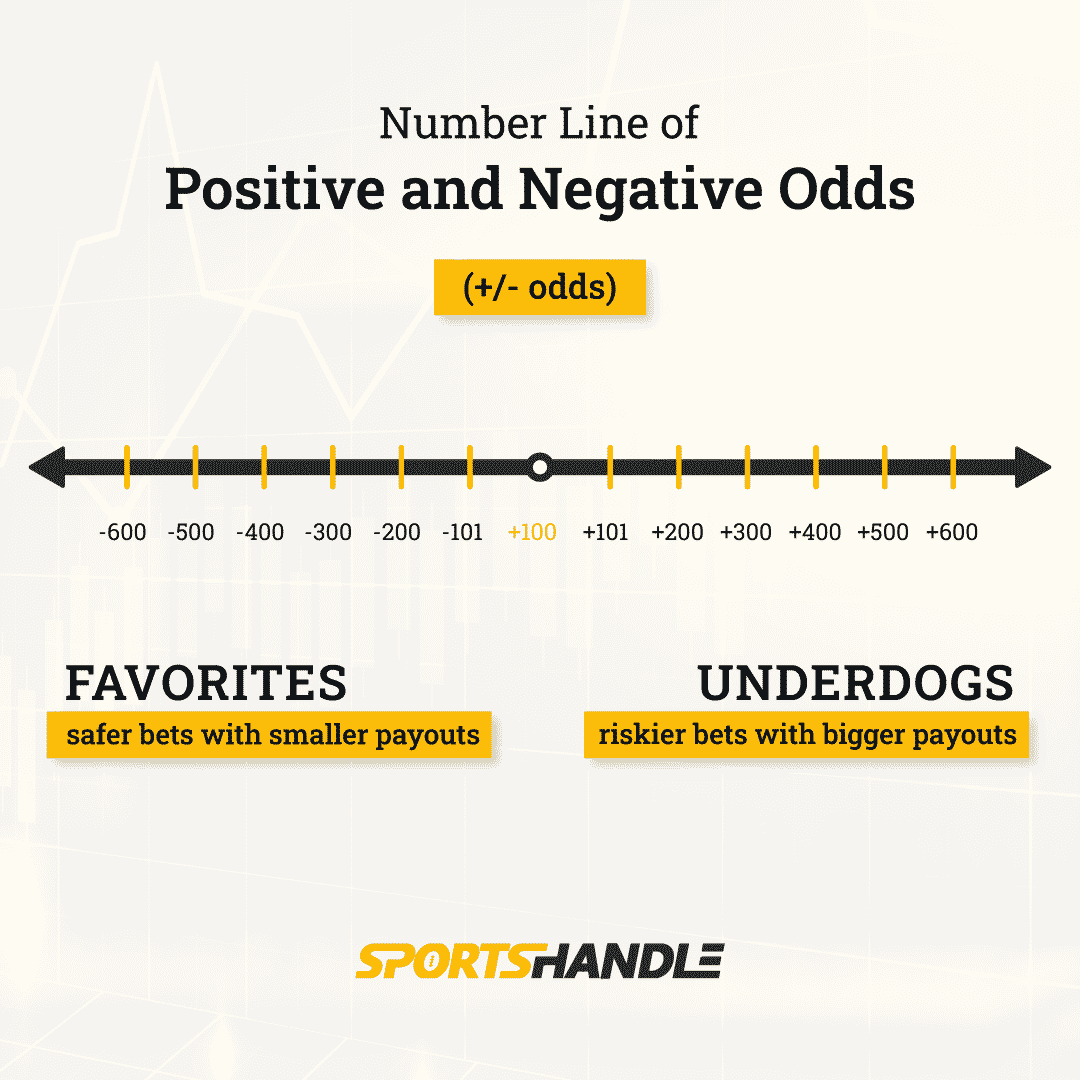

The moneyline is the simplest way to bet on a sporting event. The moneyline assigns value to each team in a match. It's misleading, however, because you aren't betting on a winning team. Instead you're betting about the money required to win that particular wager.

There are many options for placing a bet. But if you want to quickly and easily get involved in a game, the moneyline may be the right choice. A bettor will place a bet on the moneyline, and if they win, they'll win their original stake plus the winnings. While moneylines can be used in a variety of sports, it's most commonly used in American football, basketball and golf.

The moneyline is not for everyone. Bets on the underdog are a fun and exciting way of betting. An underdog's odds of winning are typically half those of a favorite. The underdog's chances of success can be bet upon while the risk-to-reward ratio is maintained. And the higher the odds, you will make more!

On the other hand, a bet on the point spread will likely put you in the red. Point spreads are useful as they can give you an indication of how well a team is able to cover. Similar to a moneyline it is the best way for you to bet if the game looks close. If the odds of an underdog winning is high, it's likely that you are in the right mental frame to place a wager. If the odds are low you will want to wager on the high-end.

The case of the Golden State Warriors is a good example of how money lines work. Their moneyline was at -600. That's a lot of money to bet on a team that has a 17% chance of winning, if the Warriors are favored by two points. The Cavaliers have a better track record than Golden State, but they were playing them. The Warriors are more affected by this gimmick.

An over/under bet is another way to wager on the big event. While this can be more challenging than a moneyline wager, it is a smart move when you believe the odds of winning are high. Of course, the best advantage of the over/under bets is that you can wager on more teams and play more games than with a moneyline.

Moneyline bets might not be for everyone. However, they can offer a great way to earn some cash if done correctly. Moneyline betting allows you to wager on the winner and not worry about whether or no tie will occur. Be cautious when making a bet, however, and keep in mind that you'll only win the most likely outcome.

FAQ

Which side hustles are most lucrative?

Side hustle is an industry term that refers to any additional income streams that supplement your main source.

Side hustles can be very beneficial because they allow you to make extra money and provide fun activities.

Side hustles are a way to make more money, save time, and increase your earning power.

There are two types of side hustles: passive and active. Side hustles that are passive include side businesses such as blogging, e-commerce and freelancing. You can also do side hustles like tutoring and dog walking.

Side hustles that are right for you fit in your daily life. Consider starting a business in fitness if your passion is working out. You may be interested in becoming a freelance landscaper if your passion is spending time outdoors.

Side hustles are available anywhere. Side hustles can be found anywhere.

If you are an expert in graphic design, why don't you open your own graphic design business? Perhaps you are a skilled writer, why not open your own graphic design studio?

Do your research before starting any side-business. This way, when the opportunity arises, you'll be ready to jump right in and take advantage of it.

Side hustles are not just about making money. Side hustles can be about creating wealth or freedom.

There are so many opportunities to make money that you don't have to give up, so why not get one?

What is personal finance?

Personal finance is about managing your own money to achieve your goals at home and work. It is about understanding your finances, knowing your budget, and balancing your desires against your needs.

These skills will allow you to become financially independent. This means that you won't have to rely on others for your financial needs. You can forget about worrying about rent, utilities, or any other monthly bills.

Not only will it help you to get ahead, but also how to manage your money. It makes you happier. Positive financial health can make it easier to feel less stressed, be promoted more quickly, and live a happier life.

What does personal finance matter to you? Everyone does! Personal finance is the most popular topic on the Internet. Google Trends has shown that searches for personal finance have increased 1,600% from 2004 to 2014.

People use their smartphones today to manage their finances, compare prices and build wealth. These people read blogs like this one and watch YouTube videos about personal finance. They also listen to podcasts on investing.

Bankrate.com says that Americans spend on the average of four hours per day watching TV and listening to music. They also spend time surfing the Web, reading books, or talking with their friends. That leaves only two hours a day to do everything else that matters.

You'll be able take advantage of your time when you understand personal finance.

Why is personal finances important?

For anyone to be successful in life, financial management is essential. We live in a world where money is tight, and we often have to make difficult decisions about how to spend our hard-earned cash.

So why should we wait to save money? Is there nothing better to spend our time and energy on?

The answer is yes and no. Yes, because most people feel guilty when they save money. You can't, as the more money that you earn, you have more investment opportunities.

You'll always be able justify spending your money wisely if you keep your eyes on the bigger picture.

You must learn to control your emotions in order to be financially successful. Negative thoughts will keep you from having positive thoughts.

It is possible to have unrealistic expectations of how much you will accumulate. This is because you aren't able to manage your finances effectively.

These skills will allow you to move on to the next step: learning how to budget.

Budgeting refers to the practice of setting aside a portion each month for future expenses. Planning will allow you to avoid buying unnecessary items and provide sufficient funds to pay your bills.

So now that you know how to allocate your resources effectively, you can begin to look forward to a brighter financial future.

How much debt is too much?

It is vital to realize that you can never have too much money. Spending more than what you earn can lead to cash running out. This is because savings takes time to grow. Spend less if you're running low on cash.

But how much can you afford? Although there's no exact number that will work for everyone, it is a good rule to aim to live within 10%. You'll never go broke, even after years and years of saving.

If you earn $10,000 per year, this means you should not spend more than $1,000 per month. You shouldn't spend more that $2,000 monthly if your income is $20,000 For $50,000 you can spend no more than $5,000 each month.

Paying off your debts quickly is the key. This includes student loans, credit card debts, car payments, and credit card bill. When these are paid off you'll have money left to save.

It would be best if you also considered whether or not you want to invest any of your surplus income. If you choose to invest your money in bonds or stocks, you may lose it if the stock exchange falls. However, if you put your money into a savings account you can expect to see interest compound over time.

Let's take, for example, $100 per week that you have set aside to save. It would add up towards $500 over five-years. You'd have $1,000 saved by the end of six year. You'd have almost $3,000 in savings by the end of eight years. You'd have close to $13,000 saved by the time you hit ten years.

Your savings account will be nearly $40,000 by the end 15 years. Now that's quite impressive. However, if you had invested that same amount in the stock market during the same period, you'd have earned interest on your money along the way. Instead of $40,000 in savings, you would have more than 57,000.

That's why it's important to learn how to manage your finances wisely. A poor financial management system can lead to you spending more than you intended.

What is the fastest way to make money on a side hustle?

To make money quickly, you must do more than just create a product/service that solves a problem.

You also have to find a way to position yourself as an authority in whatever niche you choose to fill. This means that you need to build a reputation both online and offline.

Helping others solve problems is the best way to establish a reputation. You need to think about how you can add value to your community.

Once you've answered that question, you'll immediately be able to figure out which areas you'd be most suited to tackle. Online earning money is possible in many ways. However, these opportunities are often highly competitive.

If you are careful, there are two main side hustles. The one involves selling direct products and services to customers. While the other involves providing consulting services.

Each approach has its pros and cons. Selling products or services gives you instant satisfaction because you get paid immediately after you have shipped your product.

On the flip side, you might not reach the level of success you desire unless you spend time developing relationships with potential clients. These gigs are also highly competitive.

Consulting can help you grow your business without having to worry about shipping products and providing services. However, it can take longer to be recognized as an expert in your area.

You must learn to identify the right clients in order to be successful at each option. It will take some trial-and-error. But, in the end, it pays big.

How to make passive income?

To generate consistent earnings from one source, you have to understand why people buy what they buy.

It is important to understand people's needs and wants. You must learn how to connect with people and sell to them.

You must then figure out how you can convert leads into customers. You must also master customer service to retain satisfied clients.

You may not realize this, but every product or service has a buyer. If you know the buyer, you can build your entire business around him/her.

It takes a lot of work to become a millionaire. You will need to put in even more effort to become a millionaire. Why? To become a millionaire you must first be a thousandaire.

Finally, you can become a millionaire. And finally, you have to become a billionaire. You can also become a billionaire.

How do you become a billionaire. It starts by being a millionaire. All you have to do in order achieve this is to make money.

Before you can start making money, however, you must get started. Let's look at how to get going.

Statistics

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

External Links

How To

Passive Income Ideas To Improve Cash Flow

There are many ways to make money online, and you don't need to be hard working. Instead, there are ways for you to make passive income from home.

Automation could also be beneficial for an existing business. If you are thinking of starting a business, you might find that automating parts of your workflow can help you save time and increase productivity.

The more automated your business becomes, the more efficient it will become. This will allow you to focus more on your business and less on running it.

Outsourcing tasks is a great method to automate them. Outsourcing lets you focus on the most important aspects of your business. You are effectively outsourcing a task and delegating it.

You can now focus on what is important to your business while someone else takes care of the details. Outsourcing can make it easier to grow your company because you won’t have to worry too much about the small things.

Another option is to turn your hobby into a side hustle. Using your skills and talents to create a product or service that can be sold online is another way to generate extra cash flow.

For example, if you enjoy writing, why not write articles? There are many places where you can post your articles. These websites allow you to make additional monthly cash by paying per article.

It is possible to create videos. You can upload videos to YouTube and Vimeo via many platforms. These videos can drive traffic to your website or social media pages.

Investing in stocks and shares is another way to make money. Investing is similar as investing in real property. You are instead paid rent. Instead, you receive dividends.

These shares are part of your dividend when you purchase shares. The amount you get depends on how many shares you purchase.

If you decide to sell your shares, you will be able to reinvest the proceeds into new shares. This will ensure that you continue to receive dividends.